Accounting Cycle Simplified: A Step-by-Step Guide for Businesses

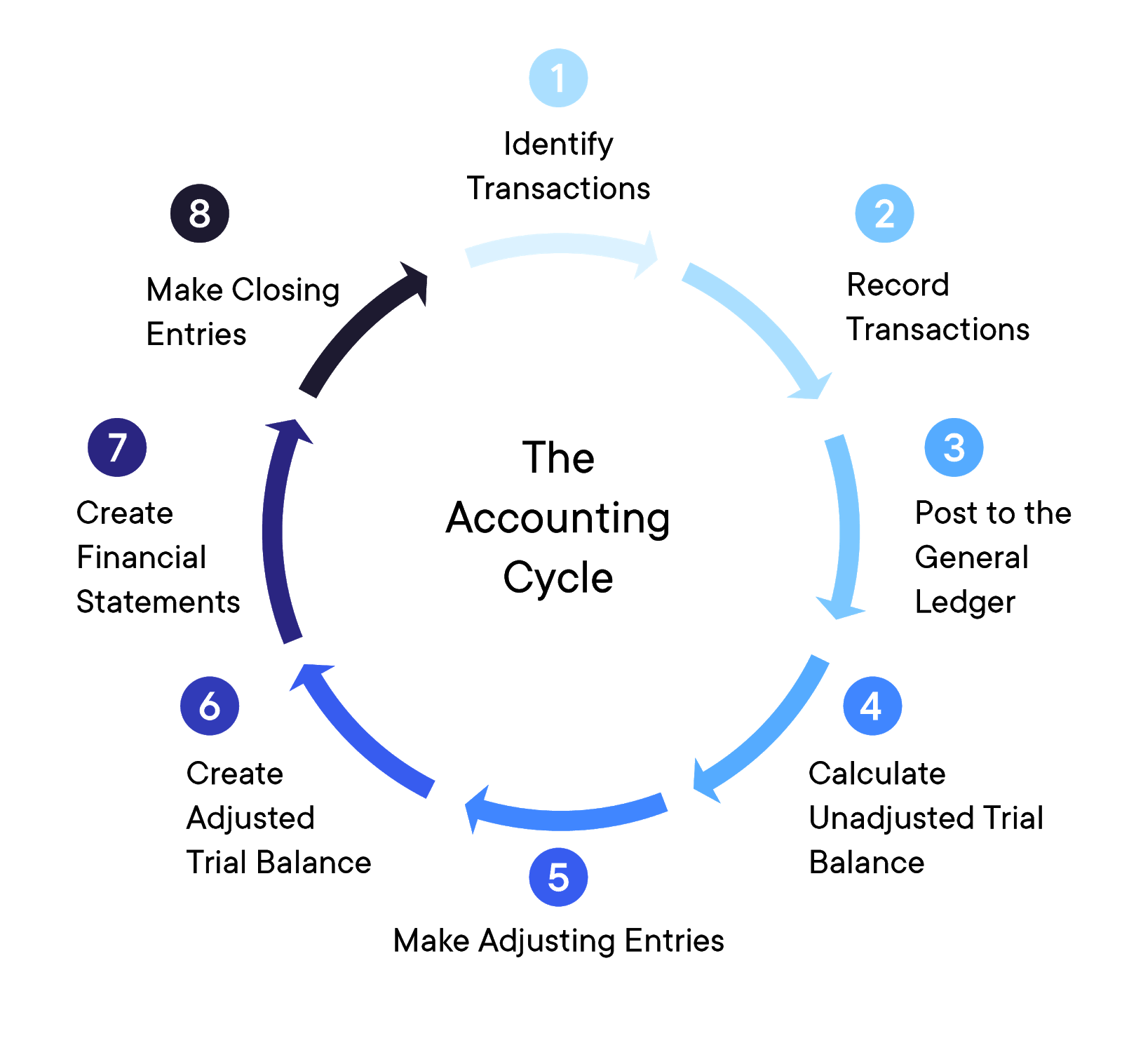

Disorganized books can lead to bad decisions, failure to fulfill various obligations and sometimes even legal problems. That’s why today we will discuss the eight accounting cycle steps you can follow to ensure accuracy. At the end of the accounting period, companies must prepare financial statements. Public entities need to comply with regulations and submit financial statements before specified deadlines.

Accounting cycle time period

An example of an adjustment is a salary or bill paid later in the accounting period. Because it was recorded as accounts payable when the cost originally occurred, it requires an adjustment to remove the charge. Before you create your financial statements, you need to make adjustments to account for any corrections for accruals or deferrals. However, you also need to capture expenses, which you can do by integrating your accounting software with your company’s bank account so that every payment will be charged automatically. The accounting cycle helps produce helpful information for external users, such as stakeholders and investors, while the budget cycle is used specifically for internal management.

Preparing Post-Closing Trial Balance

In conclusion, preparing final statements is a crucial step in the accounting cycle, as it informs decision-makers about the financial performance and position of a company. To ensure accuracy and reliability, it is essential to record transaction details, like the date, amount, parties involved, and any relevant documentation. Proper classification and documentation make it easier to track the impact of these events on the business’s financial position.

Closing Temporary Accounts

- The purchase order, on the other hand, is an external document sent to suppliers, typically created and approved by the purchasing department to order equipment, items, or products for the company.

- All account balances are extracted from the ledger and arranged in one report.

- The next step is to record your financial transactions as journal entries in your accounting software or ledger.

- After posting is complete, we will be able to see all increases and decreases in Cash; and from that, we can determine the remaining balance.

- The accounting cycle includes eight steps required to record transactions during an accounting period.

Some popular accounting software options include QuickBooks, Xero, and Zoho Books. It is important to choose the right software that meets the company’s specific needs and integrates seamlessly with their operations. The accounting cycle is an eight-step process that accountants and business owners use to manage the company’s books throughout a specific accounting period, such as the fiscal year. The accounting cycle is critical because it helps to ensure accurate bookkeeping. Skipping steps in this eight-step process will likely lead to an accumulation of errors.

Journal Entries and Documentation

You need to perform these bookkeeping tasks throughout the entire fiscal year. A shorter internal accounting cycle can make bookkeeping more manageable, especially when the company’s finances are complicated. However, businesses with internal accounting cycles also follow the external accounting cycle of the fiscal year. An example of identifying transactions would start with point-of-sale software. Many of these software options automatically identify a transaction. Now, let’s have a closer look on the complete accounting cycle process by performing the following example step by step.

What is transactional accounting?

With double-entry accounting, common in business-to-business transactions, each transaction has a debit and a credit equal to each other. It gives a report exporting cryptocurrency transactions to xero of balances but does not require multiple entries. Regardless, most bookkeepers will have an awareness of the company’s financial position from day to day.

An outstanding feature is its ability to automate nearly 50% of manual repetitive tasks, achieved through a No Code platform, LiveCube. This innovative tool replaces Excel, automating data fetching, modeling, analysis, and journal entry proposals. For example, when the bookkeeper notices that the cash account was debited by $100 instead of $1,000, the bookkeeper must pass an adjusting entry for $900 to correct the balance in the cash account. Once you recognize an error, you’ll need to correct the figures in your accounting system or pass an additional journal entry. A worksheet is where you adjust the “unadjusted” trial balance if needed. If the trial balance reveals errors, the worksheet can help identify the reason for it.

One of the most commonly referenced accounts in the general ledger is the cash account which details how much cash is available. Once you identify your business’s financial accounting transactions, it’s important to create a record of them. You can do this in a journal, or you can use accounting software to streamline the process. These financial statements are the most significant outcome of the accounting cycle and are crucial for anybody interested in comparing your business’s performance with others.

A trial balance helps verify the arithmetical accuracy of recorded transactions. If the debits don’t equal the credits, the bookkeeper might have recorded one of the figures incorrectly. Cash accounting requires transactions to be recorded when cash is either received or paid. Double-entry bookkeeping calls for recording two entries with each transaction in order to manage a thoroughly developed balance sheet along with an income statement and cash flow statement.

Also known as Books of Final Entry, the ledger is a collection of accounts and shows the changes made to each account from past transactions recorded. To simplify the recording process, special journals are often used for transactions that recur frequently, such as sales, purchases, cash receipts, and cash disbursements. And, a general journal is used to record all those that do not fit in the special journals. Permanent accounts are accounts that continue to accumulate balances across multiple accounting periods. They include asset, liability, and equity accounts, such as Cash, Accounts Receivable, Accounts Payable, and Common Stock.

Mapping out plans and dates that coincide with your accounting deadlines will increase productivity and results. Completing the accounting cycle can be time-consuming, especially if you don’t feel organized. Here are some tips to help streamline the bookkeeping process and save you time. After the need is identified, the requesting department creates a purchase requisition, which must be approved by authorized personnel. The requisition is then forwarded to relevant departments such as purchasing, accounting, receiving, and kept as a record by the requesting department.